The amount of money coming in needs to be greater than the amount of money going out. The truth is that most people don’t know where their money goes every month. In reality, it is enlightening and empowering. Personal budgeting sounds like a boring and constricting thing to do. (use the information you gathered from talking with financial aid offices at your institution)

You will have to estimate expenses for many items (e.g.

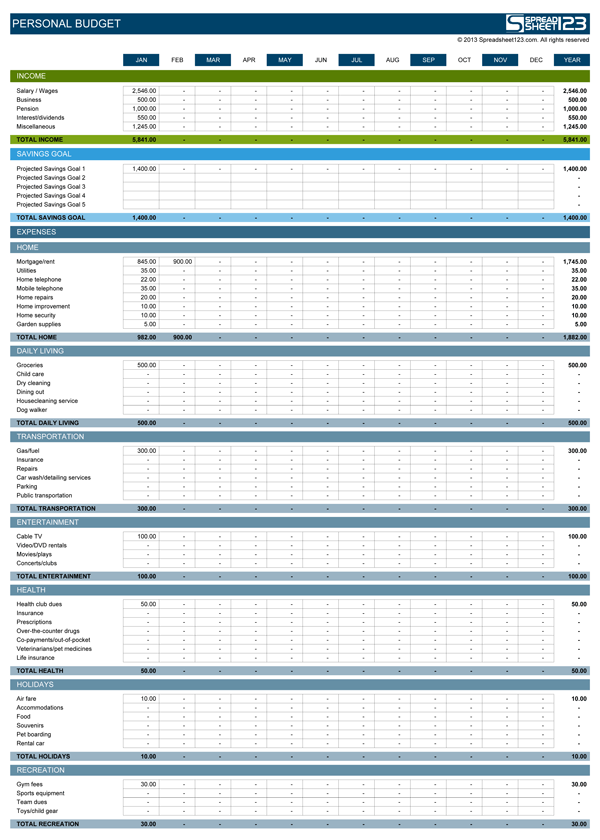

The easiest way to start is to break down your monthly expenses and add the costs associated with school. Using your word processor program, prepare a simple budget showing how you would pay for 1 year of your program at a post-secondary institution. Can you think of some wants you could eliminate from your budget while you are a student? How about making coffee instead of buying coffee? Buying less clothing? Going out to movies less often and staying home to watch one instead? You may find it is easier to eliminate some expenses that are wants rather than needs. You may have to let go of some wants when you return to school. When returning to school, most people have to really think about their needs versus their wants : Needs vs. For students, a budget helps them plan for future school expenses, keeping in mind all sources of income, including student loans, grants and earnings from part-time work or full-time summer jobs. Making a BudgetĪ budget is a document that tracks the money you have coming in including sources of income, and the money you have going out to pay for your expenses. You may need these notes for your Budget assignment (coming soon!). Jot down some notes after talking with the financial aid people. The people in this office may suggest other options for funding that you are not aware of. Talk to someone from the financial aid office at your school of choice.

0 kommentar(er)

0 kommentar(er)